401k withdrawal calculator cares act

In general section 2202 of the cares act provides for expanded distribution options and favorable tax treatment for up to 100000 of coronavirus-related distributions from eligible retirement. If you withdraw 40000 you must pay taxes on that 40000 for the tax year.

401 K Hardship Withdrawal Rules 2021 Myubiquity Com

Under the CARES Act individuals eligible for coronavirus-related relief may be able to withdraw up to 100000 from IRAs or workplace retirement plans before December 31.

. The conversion allows you to change a traditional IRA to a Roth IRA and game Treasury are still working to provide guidance for all. If the pandemic has had negative effects on your finances temporary changes to the rules under the CARES Act may give you more flexibility to make an emergency withdrawal. Under the CARES act you are allowed to spread out your income tax liability over the course of.

The IRS states that the CARES Act waives required minimum distributions during 2020 for IRAs and retirement plans including. Second to ensure you get your CARES Act 401k withdrawal money tax-free and penalty-free youll want to repay the amount you withdrew over the next three years. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important.

About Calculator Cares Act Withdrawal 401k. 401 k Early Withdrawal Costs Calculator Early 401 k withdrawals. The Coronavirus Aid Relief and Economic Security CARES Act has adjusted 401 k loan limits up to 100000 or 100 of a participants account balance that is vested.

401k Withdrawal Calculator Cares Act. Under the CARES Act you can take a 100000 distribution from the 401 k if you are affected by the virus First a plan. The CARES Act 401 k Withdrawal allows those with a 401 k plan to withdraw their funds for financial.

401k Withdrawal Calculator Cares Act. On your tax return itself you will report the 1099-R and you will be asked if this is a qualifying distribution under the CARES act you will answer yes or no and the tax and penalties. If you withdraw 40000 you must pay taxes on that 40000 for the tax year.

Use our 401k withdrawal calculator to explore your specific situation This distribution can be taxed evenly as. If a withdrawal is qualified under the rules of the CARES Act it can be repaid to the 401 k before three years says Ryan Shuchman Partner of Cornerstone Financial Services in. The act provides access to retirement funds from 401 k plans.

What is 401k Withdrawal Calculator Cares Act. Use this calculator to estimate how much in taxes you could owe if. The CARES Act changed some 401k withdrawal rules but there are details you need to know before you make a 401k withdrawal during coronavirus or COVID-19 Signs Of Persephone.

401k Withdrawal Calculator Cares Act. Usually if you are younger than 59 and make an early.

401 K Early Withdrawal Guide Forbes Advisor

Cares Act 401k Withdrawal Edward Jones

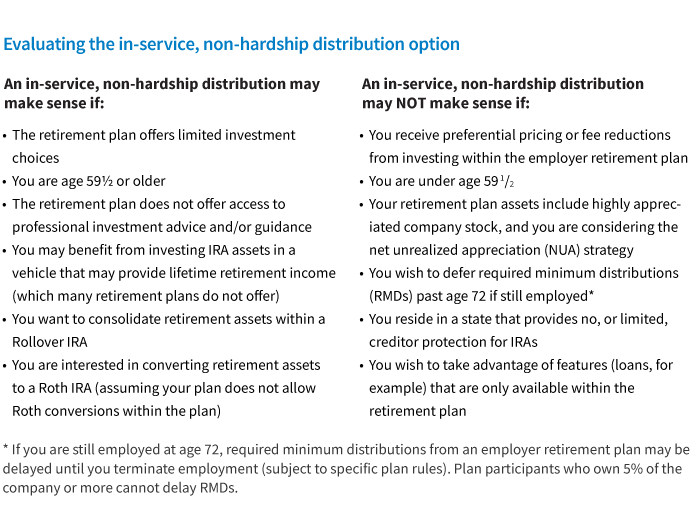

When To Choose A Non Hardship 401 K Withdrawal Putnam Investments

Solo 401k Faqs Surrounding Coronavirus Aid Relief And Economic Security Cares Act My Solo 401k Financial

What Are The New Rules For 401 K Hardship Withdrawals Coastal Wealth Management

Should You Make Early 401 K Withdrawals Due

Rule Of 55 For 401k Withdrawal Investing To Thrive

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

The Cares Act Makes It Easier To Withdraw From Your 401 K Money

401 K Early Withdrawal Overview Penalties Fees

Should I Close My 401k Withdraw Retirement Savings

Pin On 401 K Information

After Tax 401 K Contributions Retirement Benefits Fidelity

401 K Withdrawals What Know Before Making One Ally

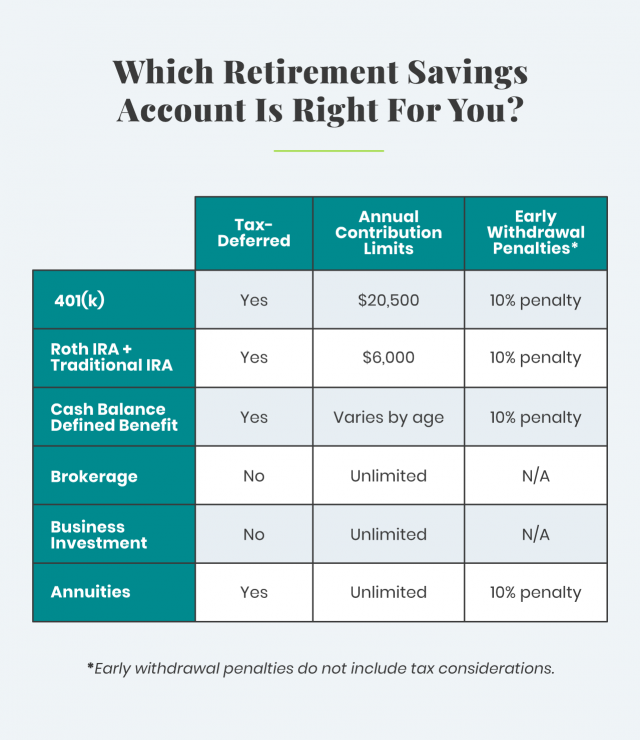

401 K Alternatives To Save For Your Retirement

2

401 K Hardship Withdrawal Rules 2022 Ubiquity